Tuesday, December 22, 2015

Thursday, December 17, 2015

November 2015 Two Wheeler Sales - Snapshot

|

| Source: AutocarPro |

Bikes/Motorcycle Sales -

Moped Sales -

Detailed Model-wise report will be shared shortly

Monday, December 14, 2015

Car Sales Projection for 2015

The Indian Auto Industry is estimated to grow by over 7% this Calender Year. While we'll present the actual sales data for 2015 in Jan'16; do find our predictions we estimate for this CY OEM-wise here. The overall industry size is touted to cross 27 lakh units this year (~27.3 lakhs including luxury segment). The highlights of our analysis is:

- -The growth in passenger cars would be primarily fueled by the Top 3 OEM's - namely Maruti, Hyundai and Honda.

- -Hyundai will emerge as the OEM with the highest growth this CY. Hyundai's entry into SUV space (through Creta) has proved to be the catalyst to this growth.

- -Maruti will maintain its dominance by a huge margin and would end at a Market Share of over 48%. The introduction of Nexa models has proven to be positive and we foresee stronger performance ahead.

- -The state of affairs at the Top 3 losers (GM, Fiat and Nissan) looks worrisome. These OEM's will have to do something radical in CY16 to avoid further slump. We have already presented our recommendations for GM here.

- -VW to have a tougher time in next CY - can the German auto major avoid the downfall? Only time will tell.

- -Mahindra did gain some ground with TUV 300, however the overall sales haven't been encoraging for this Indian MNC. With KUV100, the tables can turn very soon and put the OEM back to No.3!

Wednesday, December 9, 2015

Bike Taxi: The next commuter/transportation revolution in India?

Prologue: I landed at Bangalore airport and had an urgent meeting at Hosur Road scheduled in next 2 hours. And I get to experience the infamous Bangalore traffic and arrived at the meeting venue only after 3 hours (all thanks to major traffic junctions such as Hebbal, Manyata Tech Park, KR Puram, Marathalli, Silk Board etc). I lose a major deal and the effort of my visit to Bangalore was nullified.

The above situation is not only a reality for Bangalore, but for almost all metropolitan cities in India. While the taxi hailing apps have found tremendous acceptance, a gap is yet to be filled. Even though cabs provide the luxury of being chauffer driven and carrying luggage around; time is something that it can't substitute.As a resident of Bangalore, I can very confidently say that 'Two wheelers are the fastest mode of transportation in the city'. The age of Bikes being used as commercial taxi is now here. There is definitely a latent need and has yet to be realized by service providers in the sub-continent.

Bikes as Taxis are already well-accepted in Goa (driven by men called pilots) and many developing countries worldwide. Its extensive usage has been seen in highly congested cities like Jakarta in Indonesia and in many cities of Japan and Vietnam. Find here the terminologies used for bike taxis in various parts of world:

|

| Terminology for Bike Taxis worldwide |

Indonesia can be cited as the most suitable where bike taxis have flourished and start-ups providing the service have grown multifold. The best example for flourishing bike taxi startup can be Go-Jek and GrabBike. Both combined already have over 80,000 registered bike taxi riders in South East Asia!

|

| Bike Taxis seen at a junction in Bangkok (identified by Orange Vests worn by the drivers) |

Image Source- Scooters Bangkok Nana by Khaosaming

Why Bike Taxi can work in India -

- Time-saver : Yes, Time is one of the most important factor in today's transportation!

- Last mile connectivity: There is no place that can't be reached in a 2-wheeler.

- Chauffer-driven Bike: Can save you from the hassles of riding in strenuous traffic conditions.

- Pocket Friendly: Obviously, the critical factor and let's see the comparison with a traditional 4-wheeler taxi -

One would save over Rs.130 on a 10km travel in a Bike Taxi vis-a-vis a cab ride. PS: The Bike Taxi fares are calculated using the fares announced by recently formed Indian startup named Baxi. While similar startups are seeded in Delhi/NCR, the current Motor Vehicles Act is not encouraging similar businesses at other cities. With minor amendments in the Act, we expect the trend to catch the fancy of the Indian traveler and predict multi-fold growth in the acceptance of service.

Challenges for Bike Taxi in India:

- Motor Vehicle Act: Lack of licensing pushed companies such as "Bikees" and "HeyTaxi" to reconsider their business operations.

- Safety Concern: The biggest challenge to the passengers will be safety considering Indian road/driving conditions are not favorable to bikers and exposure to rains/sunlight/wind is also there. (However, in developed nations, safety measures such as mandatory helmets, airbag vests, etc are being used for pillion riders.)

- 3-wheelers / Autos: Auto Rickshaws already claim to provide the benefits of low-cost transportation and seems to be a safer alternative to bikes.

Current Players in the market -

|

| Source: ET |

We at Management Punditz think that Baxi and M-Taxi have taken steps in the right direction and expect radical evolution in the way people would commute in Bike Taxis. Will they be as disruptive as Olas and Ubers? - only time will tell.

Saturday, December 5, 2015

Indian Car Sales Figures - November 2015

|

| November 2015 Sales Figures - Pan India |

- - Maruti proved again why it is the Big Daddy of the Indian Automotive Space. It has put everything to shape up the new Channel - Nexa. While Nexa experienced initial struggle in building equity through S-Cross; Baleno has made a significant impact by jumping to the 7th best selling car in India! However, the Numero Uno car maker couldn't sustain Swift's volumes and the cannibalization seemed inevitable.

- - Alto again pipped Dzire to stand on top of the table. The entry hatch segment as a whole has proved to be interesting. While Alto continues its dominance; Eon and Kwid are performing equally impressive as well. The baby Renault (Kwid) has set a new benchmark in the segment and has renewed the Indian consumers interest in the segment which was slowly losing steam. Hyundai's approach is also appreciable - all efforts aligned by the Korean major to avoid losing Eon numbers to Kwid.

- - While Baleno was raking the moolah, Grand i10 did the impossible (or was it?) - It overtook the segment leader by a margin (>1000 units!). Hyundai Grand i10 exceeded Swift's volumes for the first time since its launch! Also interesting to see i20 volumes being untouched even with Baleno's success.

- - Mahindra is trying to jump into shape through TUV. The picture seems positive as of now - M&M places itself 3rd in the OEM table. However, the sales of mentioned brands is a big question mark - Quanto (2), Rexton (4), Vibe (47) and Verito (174).

- Honda's sales statistics again startles us - Jazz volumes lower than Amaze? The premium hatchback space has seen a turnaround - but Jazz numbers indicate that it is slowly losing steam? Also worrisome for Honda is Mobilio's volumes - 89% de-growth! (as a matter of fact, Mobilio's numbers has been lower than Lodgy as well).

- Ford - The only product in the portfolio which had a month-on-month growth was Ecosport! The newbies (Aspire and Figo) are already struggling to provide steady volumes.

- It is saddening to see Tata's most capable product - Zest's decline in numbers. We otherwise have tremendous expectations from Zica - will this pull Tata out of the debacle?

We also share our concerns with the recent Chennai flood. Not only the Detroit of India has seen irrevocable damages in the past few days, the Automotive Manufacturing Plants in the area will take quite some time to recover. We pray for speedy recovery of the city and also salute the spirit of Chennai in these tough times.

A look at the Top 25 selling cars -

Tuesday, December 1, 2015

Sunday, November 29, 2015

Premium Hatchback Sales Trend - India

Indian market has evolved unexpectedly and OEMs are finding it difficult to plan their product portfolio citing the change in consumer mindset and difficulty in identifying the trends. We had coined the term 'UV'ology in 2012 seeing the impressive growth of the segment and the influx of new models to cash in the phenomena (say Ertiga, Duster, Ecosport XUV etc). However, the trend slowed down in the UV's and Indian consumers focus shifted to other segments.

The reason the Premium Hatchback segment is being analyzed is:

- - It is one of the fastest growing segment in 2015: The segment grew astounding 276% in year 2015 v/s 2009. Also the growth was 96% in 2015 when compared to 2014.

- - The Big 3 of the Indian Automotive Space (Maruti, Hyundai & Honda) now have a competitive product in the segment and will define their growth prospective ahead.

- - Percentage contribution of these models to their respective OEMs - Ex: i20 Elite+Active contributes to over 28% of Hyundai's sales in India! The story is similar for Jazz as well where the model currently forms over 25% of Honda's sales.

A look at the sales volumes of the cars in the segment in past 7 years:

|

| Sales Statistics |

|

| Growth Chart |

Hyundai i20 remains the undisputed leader in the segment and in a way has defined the segment itself. Many players jumped into the premium hatch space, but were unable to catch the fancy of the Indian Buyer - Jazz & Punto saw initial positive response, however couldn't gain the expected volumes. While the previous generation Jazz was discontinued in July 2013, even Punto faced issues crossing the >500 sales mark.

Snapshot of major updates in the segment:

- * Hyundai was the first automobile company to crack the segment and have the first successful product in the category. i20 set up new benchmark in sales over years and the current generation clocked over 1.5 Lakh unit sales in just 14 months (since its launch in Sep'14)

- * Hyundai was again a pioneer in the segment - It had launched Getz way back in 2004 and had to stop its production owing to poor sales in 2010 (it was refreshed as Getz Prime in 2007). The response for Getz wasn't encouraging - however, it did not stop Hyundai to explore and launch first gen i20 in 2008 which proved to be an excellent decision and elevate Hyundai into the premium category. Even biggies like Honda were not able to make any effect with previous Jazz in the segment.

- * Honda understood that it had lost a valuable pie in the premium hatch category due to hefty pricing of Jazz, which otherwise would have helped the Japanese major to gain volumes in the tough times (2009-2012). However, Honda realized its mistake and bought in the new Jazz with diesel engine option and announced an aggressive price with it. The car has seen assuring response and looks forward to grow even stronger in coming days.

- Polo remains VW's most successful product in its portfolio which highlights the response of the segment's customer. Though the sales of Polo has varied over years, VW recognizes that a fresh update can renew sales to newer heights.

- * Maruti too realized that the Indian customer would slowly shift its preference towards the premium hatch because of -

- > Ease of maneuverability of hatches in crowded cities

- > Youth wants a compact, spacious and stylish car - all boxes ticked by a premium hatch

- > The current buyer wants a feature rich car and wouldn't mind paying a premium for the same

- * The aforementioned reasons made India's no.1 carmaker to enter the segment with its latest offering Baleno and also market it through a new channel - Nexa to deliver the premium message with the offering.

We expect the segment to deliver similar growth in coming time and do not be surprised to see other OEMs jump in this bandwagon. Baleno & Jazz again have a lot riding on their shoulders to define their respective OEMs performance in India.

Thursday, November 26, 2015

Sunday, November 22, 2015

Top 10 Selling Cars of the Top 10 Cities in South India!

Management Punditz has been consistently studying the Indian Automotive Market and are pleasantly surprised by the complexity seen in the past few years. India is termed a sub-continent for a reason - its size, population, variety, culture and demographics is multifaceted. Though we have been analyzing the car sales data for the entire country, we start our regional study with this post by reviewing the Top 10 cars sold in the Top 10 cities of South India. We had a specific reason to start with South India -

- * South India contributes to over 28% of the overall National Sales Volumes!

- * Bangalore, Hyderabad, Chennai and Kochi - 4 cities from South rank in Top 10 car selling cities in India (source).

- * The contribution of the states in South India is very similar - Karnataka stands highest and contributes to 27% of South's sales, Kerala @ 26%, TN @ 25% and AP+Telangana @ 22%.

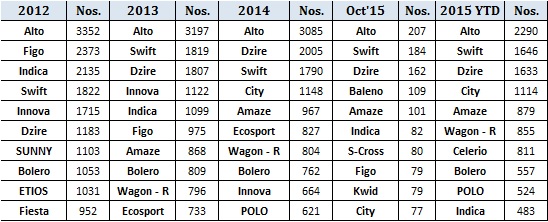

We have prepared a trend-wise chart (2012 to YTD 2015) of the Top 10 selling Brands to extract a clear picture. The sales data is presented by highlighting the All India Sales and then divided to South with further division to the respective states and later cities. Let's see the statistics -

ALL INDIA

South India

KARNATAKA

Bangalore

Mangalore

KERALA

Cochin

Calicut

Trivandrum

TAMIL NADU

Chennai

Coimbatore

ANDHRA PRADESH + TELANGANA

Hyderabad

Vijayawada

Vizag

Points to Note (considering 2015 YTD numbers):

- > While the Top 3 selling cars predominantly remain from the Maruti stable - Do see how Dzire easily takes the TOP slot in multiple markets. Also to be considered - Swift ranks no.1 in markets such as Cochin, Mangalore and Bangalore!

- > Indica sells more than Alto in Chennai! Also Indica ranks 8th in South India ranking! Taxi effect probably (or say Ola!)

- > City's sales is higher than Grand i10, Indica and i20 sales in TN.

- > Bolero, which is India's best selling SUV is absent in the aforementioned rankings (except Coimbatore) - low brand equity for the SUV in South? Also, only XUV 500 remains the only other Mahindra product to feature in the Top 10 ranking (ranked 10th in Cochin).

- > No. 4 rank is a surprise in many markets - Indica ranks 4th in Hyderabad, Grand i10 for AP+Telangana, Alto in Chennai, City in Coimbatore, Celerio in Calicut.

- > Innova's sales in South is highest amongst all 4 Zones (South/North/East/West). South contributes to 38% of National Innova sales. Case is similar to Etios as well - South contributes to over 53% of overall Etios sales!

Oct'15 Top 10 statistics is also interesting for many markets:

- - Baleno makes an entry in Top 10 figures of Vizag, Cochin, Calicut, Coimbatore & Mangalore. It has even surpassed i20 sales in many markets as well!

- - South contributed to over 30% of Kwid's sales - effect seen in multiple city statistics of South.

- - S-Cross sold more than Creta in Hyderabad (Oct'15)

- - Ford's Figo and Aspire makes an entry in the Top10 slot in many markets!

No wonder many new OEMs entering the Indian market are finding it difficult to decode the success mantra! Do note that only Maruti has been able to consistently perform in ALL markets and is hence the Market Leader.

Friday, November 20, 2015

Automotive Industry in Pakistan

While we extensively cover Indian Auto Industry, we

were amazed by the similarities/differences other Automotive markets has to

cater. Previously, we assessed the US auto market and our quest to different

markets landed us to study the Pakistan's Auto Industry. Though Pakistan's car

sales currently is a modest ~15k units month, the reason we are highlighting

the numbers is that it grew an impressive 54% over the same period last

year.

We are immensely surprised to see the similarities that the way neighboring countries (Pak & India) started off the Automotive Journey-

- o Suzuki entered Pakistan in September 1982 as a Joint Venture between government of Pakistan and Suzuki Motor Company, Japan. Does it ring a bell? (In 1982, a Joint Venture was signed between Maruti Udyog Limited (which belonged to Indian Government) and Suzuki of Japan).

- o Based on July'15-Oct'15 sales data, Pak Suzuki dominated the car sales in Pakistan with a market share of near to 51%. In India, Maruti Suzuki is the market leader with a share of staggering 52%!!!

- o Honda Motor Company Limited, Japan and Atlas Group, Pakistan joined hands to form Honda Atlas Cars through a Joint Venture Agreement on August 5,1993. In India, Honda Motor Company, Japan and Usha International formed a Joint Venture in December 1995.

- o Toyota entered Pakistan in 1990 as Indus Motors which was formed post a Joint Agreement with House of Habib. Later Toyota set foot in Indian market in 1997 with a Joint Venture with Kirloskar Group.

While the aforementioned data highlights how the Pakistani and Indian

Government initially were extremely similar in their policies of allowing

foreign automotive companies to invest in their respective markets; the

similarities ends just here! Indian market had caught up the fancy of

global car makers and as on date almost ALL automotive brands could be found

here; Pakistan has limited itself to 3 Japanese Car Makers and are generations

behind the current technology these companies got to offer. But interestingly,

the Number 1 selling brand is the Toyota Corolla with an average of ~4600

units/mth (Note: Corolla sold average 500 units/month in India in the same

period). However, the numbers have a different story to project - the industry

is reeled with outdated products and the companies are literally dumping aged

brands here. Though Maruti 800's production was seized in Jan 2014, its

Pakistani counterpart (Suzuki Mehran) still sells in good volumes and is the

third best selling car of Pakistan! Let us look at the Top 10 selling cars of

Pakistan:

July 2015 to October 2015 brand-wise data:

In overall, Pakistan's car industry is carved up among just three brands, Suzuki, Honda and Toyota, assembling cars with imported parts in joint ventures with local players!

Sales Comparison for the similar period last year:

See why Pakistan's Car Market is extremely interesting and the potential it has to offer (if the Governments policy is friendly):

- --Pakistan is world's 6 most populous country in the world (India stands second in this ranking and is almost 7 times the population of Pakistan).

- --Pakistan Ranks 41 in cars productions vis-a-vis India's rank of 6 (India's car production is staggering 171 times more than Pakistan!)

- --Pakistan's car sales is 1/20th that of India. Pakistan's monthly car sales currently stand at an average of 15000 units.

- --Last FY, around 1,16,000 cars were sold to a population of 19 crore people!

- --Suzuki Mehran is the only entry level hatchback available and costs $6250 for the basic variant (which is hefty 3 times more than it would have costed in India!).

- --Even the Honda Civics and Toyota Corollas available, it is years behind offering airbags, ABS and even power windows as standard.

Sunday, November 15, 2015

The Way Forward for Brand Chevrolet in India!

PS: It is a descriptive post. Suggest reading it entirely to understand the depth.

Well traffic is an overused and over abused word in Bangalore. It’s

been 3 years and am in love with the city. Good people, excellent weather,

happening night life, lazy brunches in cafés, it’s got everything you ask for.

But getting to all these places that is a task in itself. When you are told you

need to get somewhere in Bangalore a word starting with "F" comes to

your mind. Well its fear, absolute fear of getting stuck in the road for hours.

It's like Lord Kitchener pointing that finger at you in the famous WW-1 poster

saying "You" are responsible for this traffic.

Yesterday however was a revelation. When I woke up in the

morning to step out for work Google now told me it will take me 10 minutes less

than usual because of "less traffic". Wow! Indian festivals have that

impact. I immediately got into the Vettel mode and my humble Chevy beat

suddenly looked like a Red bull racing mean machine. A slight drizzle ensured

that the weather was at its best! The beat over the week has seen only the

first 3 gears during my commute and the 4 gear seemed like a candidate waiting for

his interview turn. The fifth gear, well was next to non-existent.

Today however I had decided to push her and beat the clock to

work. As always Google was right, traffic was less and the roads were free with

a slight drizzle just enough to keep the roads wet. I revved my engine and the

beat responded as if it’s been woken up after ages. I kept the engine on boil

between 2-3k rpm continuously and the little Chevy was upto the game. She was

charging well on the wet roads with a hint of under steer maybe because of the

wet road and the fact that I was pushing the car. We hit the ring road and for

the first time in ages hit a ton on that road and soon enough I spotted a speed

breaker which on normal days was obsolete because there was no speed and seemed

like a hump. I braked and expected a rally like jump over it, but was surprised

how the little beat managed to hold ground not lose traction on a significantly

wet road and yet come to a respectable 20 kmph within seconds and soon enough

to not mess with the speed breaker. I was amazed and impressed at this little

car's capability which I had never noticed on a normal day. I decided to test

it a little more and revved again after the speed breaker. The 1.2 litre motor responded

and I was able to hit a ton again. The mid-range is not that good but today I

got to explore the top end of the car which I have never experienced over the

past 3 years because I never got the chance. As these thoughts were flowing in

my head I clearly missed a huge puddle right at the exit of the flyover. The

beat hit the puddle at 90 and I hung on. Again yet another surprise, the Chevy

held on and didn't lose the straight line stability. It transferred the

feedback via the steering that I had messed up but didn't let the car get disturbed.

This was amazing because the puddle was deep enough to reach above my fog lamps

and I was sure that there would be some damage to the bumper. With a heavy

heart I got down to check the bumper and found it to be intact as if nothing

happened. Well when I was told in most of the meetings with the dealer about

the build quality of Beat which at that point pointless theory without

experience. Today I got to see it and experience it - and was amazed at what

this little Chevy pulled out.

I settled into a saner sort of driving and started thinking,

this is a company which pioneered in safety and introduced stuff like seat

belts which changed the course of automotive history and made cars for more

than 100 years, then why is it failing in India? I have read testimonials of

customers who have walked out of crashes unscarred because of Chevy's build

quality and safety and have seen customers give high regard to Chevy for the

way they are built and for the legacy. But I feel Chevy has ignored India as a market

when other players have focussed well on the sub-continent. Let’s see the

current scenario for the American Automaker –

|

| Sales Trend - Chevrolet in India |

Chevy’s sales have dropped 48% in year 2014 when compared to year

2011. Based on current sales (31528 units till Oct’15) and forecast this year,

we expect GM to close at ~38000 units which will lead to a 66% drop vis-à-vis 2011!

But what has led to such decline for an Iconic Brand which had enviable status

in India at a particular time:

·

One of the oldest Automobile Companies in the world (as of date,

it is 104 years old!)

·

First Automobile Company to open an Assembly Plant in India (way

back in 1928!)

·

Chevy vehicles were widely featured in early Bollywood movies

(most famous were the Impala’s) and helped Chevrolet to gain a premium status

in Indian consumers mind

·

Chevy was a global marque and had immensely helped GM to remain

the No.1 Car Maker for 77 years in a row! (until Toyota snatched the top spot)

·

Chevrolet was the key to GM’s revival hopes in India and had

shown potential initially

·

Spark, Beat & Tavera were once known to be the benchmark in

their respective segments

·

One of the few automakers to have a product in every segment

(Spark – Entry level hatchback, Beat – Mid-hatchback, Sail UVA - premium hatch,

Sail NB – Sedan, Tavera & Enjoy – MUV, Cruze – premium Sedan, Captiva/now

Trailblazer – SUV)

·

Extensive network in India – Over 260 dealerships and similar number

of Workshops!

So with these many advantages, what went wrong?

Ø

Multiple failed products – Actually terming these products as

failures would be unfair, however GM pulling over these products from the

portfolio backfired (Opel Astra, Opel Corsa, Opel Corsa Sail, Chevrolet Aveo,

Chevrolet Aveo-UVA, Chevrolet Forester, Chevrolet Optra)

Ø

Negative Word of Mouth – Once the aforementioned products were stopped,

the existing owners faced trouble in servicing, availability of spares and

finally the resale value. Though the owners were extremely happy with the

performance of their cars, long-term ownership experience was jittery

Ø

No Unique Brand Philosophy – Though Chevy had an American DNA,

the products didn’t - Spark, Beat and Captiva were designed by Daewoo/GM Korea;

Sail and Enjoy were SAIC (GM China) offerings, Tavera was nothing but a

rebadged Isuzu!

Ø

Dismal Dealership Experience – The dealerships were not standard

across and the lacklustre sales attitude cost them dearly with the loss of

customer faith and trust. The dealer infrastructure as well in many cases were

not projecting the premium brand image that otherwise was required.

Ø

Improper Product Planning – Beat was an extremely promising

product when it was launched and performed impressively for quite some time.

However, no major updates on the brand made it lose steam in the Indian market

and sales went down bottom. The story remains the same for Tavera, Cruze, etc.

Also the manufacturer’s incapability of bringing India specific products led to

the downfall

Ø

High Maintenance & Serviceability Concerns – A frequent

concern shared by Chevy customers. Though Chevrolet did mega campaigning in the

name of Chevrolet Promise to highlight low maintenance; the customers weren’t

impressed.

Ø

Product Issues & Intermittent Recalls – Issues related to

brakes, clutch, etc were common in the new offerings. Also the recall of Sail

within first 6 months itself impacted the brand negatively. Tavera emission

goof up added to the despair.

Ø

Over Discounted Brand – The brand ads started looking like a grocery

shop ad with discounts on ALL its product range! The theme lost appeal on the

product characteristics and in a while meant demeaning in overall.

Ø

Low Survey Ratings – As per the latest 2015 JD Power Survey

report, Chevrolet stood last in Sales Satisfaction and 8th in

Service Satisfaction!

Recently GM has shown promise to invest even higher in India and

work towards increasing its Market Share in the sub-continent. So what will

work for this cult yet damaged brand –

§

1 Blockbuster Model – Indian consumer these days forgive very

easily. Learn something from your fellow American (Ford). Ecosport did the

magic initially and now they’ve brought Aspire & New Figo. That 1 crucial

mass product will prove to be the breakthrough to initiate the repair of Indian

Operations

§

Revamp Dealership Network – We appreciate the Automakers

decision to cut down dealers (though we are still unaware if the good dealers

are also lost). However, the dealer network needs to be supported to standardize

their infrastructure and workshops.

§

Connect with the Existing Customers – Chevy owns a handsome

number of customers already and has to make the connection much stronger. So an

over-dedicated Customer Care team and super-natural customer connect

initiatives are the need of the hour.

§

American DNA + Indian Usage – Right combination to win the

Indian Consumer. Though, this combination doesn’t mean to bring American Gas

Guzzlers to India (name Trailblazer). We need funky looking car, with acres of

space inside, run miles with great efficiency, have loads of features and costs

less as well.

§

Aggressive campaigning of Chevrolet Promise – Yes, the brand did

see some positivity when Late Karl Slym assured customers of low maintenance

when the program was launched. The campaign dwindled and neither Chevy nor

dealers seem interested. Can we have Mr. Arvind Saxena lead the charge and overhaul

the campaign?

If

only Chevy had paid more attention to India, and given India specific products

by using their vast know how of the industry, we would have seen a different

Chevrolet in India. Hope the revival that Mary Barra has been speaking about

has all this. Till then am happy with my little Chevy Beat but always concerned

as to what will happen if God forbid something goes wrong and I have to replace

some part. Till then good luck Chevy and hopefully you will get your act

straight and not fade away!!!

(Author's Profile: Manu Sasidharan. Am a hardcore petrol head, an auto enthusiast and an amateur designer. I have been in close touch with the industry for a long time and am abreast with the action in the automotive sphere. Driving is my passion and combined with a love for travelling makes me a nomad by nature. On the education front, I have done my Engg in Electrical and Electronics from Cochin university and my Management studies from Symbiosis Pune.)

Friday, November 13, 2015

Hiring an Ola/Uber versus Buying a New Car

While Ola and Uber have indeed been disruptive in their

business model and have changed the way people travel in cities; the need of personal transportation cannot be eliminated. While auto companies are worried

on this trend and has made Mr. Anand Mahindra himself to express his concern

last month – ‘There is going to be

increasing number of people who would want access to transportation and not own

object of transportation.’ The automakers surely seem concerned that these

Taxi Aggregator companies would eat onto the new car sales and consumers will

lose interest in owning cars. The

concern seems valid considering the mentioned statistics -

- · Ola plans to diversify itself into leasing business and initially pump in Rs.5000 crore into its captive leasing subsidiary (initial investment to be Rs.500 crore)!

- · Ola to purchase upto 1 Lakh cars by 2016 and offer on lease to drivers!

- · Ola already has an existing network of 2,50,000 lakh cars attached to it.

- · Ola is currently operating at 7,50,000 rides a day across 100 cities.

- · Uber is close second and has 1,50,000 drivers on it network as of date.

- · Uber also has aggressive expansion plans is targeting 10 Lakh rides/day within next 6-9 months

- · Taxi Market in India set to grow at 20% annually to $28 billion in next 5 years!

|

| Source: ET |

Descriptive Calculation:

New Car Ownership Cost for 3 year (New Car considered here is Maruti Swift Petrol LXI with ex-showroom cost of Rs.4,78,000):

Cost of using Ola/Uber for 3 years (without taking inflation/price hike/peak time charges):

As per the above calculation; both Uber & Ola project to be cost-effective and lighter on pocket. However, one needs to consider the price hikes that the operator can substantially do in 3 years and also the additional peak time charges these aggregators levy needs to be counted as well. We have taken 20% hike YoY for the consideration:

This clearly highlights that Ola can prove costly as well! Let's consider the bigger picture on why the lighter charge by Taxi aggregator companies can vary -

- - Ola/Uber is heavily discounting the current rides to get people addicted to the platform

- - All aggregators are incurring hefty losses* (focus now on increasing Market Share)

- - Once people are used to the trend, price hikes will be imminent - which will prove to be a costly affair for the daily commuter. These companies already charge 2x-3x based on the cab demand!

|

| Source: Business Today |

Also the Advantages & Disadvantages of hiring a Ola/Uber for daily commute is as mentioned:

ADVANTAGES:

- a. No Investment: For students, fresh professionals, etc purchasing car can be a big commitment. Ola/Uber is indeed a pocket friendly alternative

- b. Blessing in Traffic: For residents of Bangalore/Delhi/Mumbai - driving in traffic is the biggest concern. What better way than ride in a chauffeur driven car and also have scope to utilize the time while travelling!

- c. Settle in new cities easily: Finding it difficult to explore routes in new cities. The neighboring Taxi guy can prove to be your best friend!

- d. Luxury of being driven by a Chauffeur: Explore the second row seats! Also escape the fear of accidents, road rash, etc

- Easy Availability: With multiple players and even higher number of taxis on road, getting a cab is a 5-minute affair these days!

DISADVANTAGES:

- a. No Sense of Ownership: Car Purchase for majority of Indians is a matter of prestige and is linked to a sea of aspirations. Many customers buy a car to project a better lifestyle and car is much more then mere mode of transportation!

- b. Emergency Hassles: There is no better alternative to a own car in emergency situations (hospitals, schools, interviews, etc).

- c. Dependency: There are multiple scenarios, where your cab booking is cancelled or the cabs are over-booked. Also owning a car always has a CONVENIENCE factor attached with it.

- d. Missing Driving Pleasure: Many of us drive our cars for the intangible pleasure of driving. Can you get that in a cab?

- e. The choice of Car itself: Majority of the cabs today are the base variants or mostly Tata Indica. What about your personal taste of cars and how can you decide in which brand you want to be driven around?

- f. Safety: Incidents of irresponsible drivers causing nuisance can make you think twice as well.

Taxis these days are an international trend and their particular effect on New Car Sales is nowhere specifically seen. Take Uber as an example - It has not affected the biggest car market in the world (US) which is almost at a saturation stage (700 car penetration in a population of 1000!). We at Management Punditz very strongly believe that the uprising of Taxi usage in India will seldom have any effect on New Car Sales and in turn will add to the Overall Sales. India with a current car population penetration of 20 in 1000 people, has an immeasurable potential for New Car Sales and request OEMs to focus on understanding the consumer psyche much better rather than worrying on Taxi Aggregators as of now. (Note: Even these Taxi Aggregators are consumers by itself!).

Saturday, November 7, 2015

U.S. Car Sales Data - October 2015

While we do not cover the automobile (light vehicles) sales of United States, we couldn't resist studying their sales report of October 2015 for the following reasons -

1. The U.S. auto industry reported the best October Sales in a Decade!

2. The complex nature of the U.S auto sales relatively to India

3. The sheer size of the American Car Market - No.1 Automobile market in World

4. The best performers in the American soil vis-a-vis our subcontinent

5. Recovery of the American automobile demand and a double digit growth in Oct'15!

Generally, October is a slow month for American OEMs. But favorable economic conditions and slew of incentives led the OEMs to escape the rather slow month and deliver a growth of 13.6% growth YoY basis. The figures looked like this -

The growth was led by Light Trucks which in actual constitutes to over 57% of overall car sales! The OEMs with light trucks in their portfolio (GM, Ford, FCA) benefited the most and emerged as front runners in OEM rank tally. The drop in fuel/gas prices and lower interest rates were the key to growth. The positivity is further enabling the industry to establish a record calendar year and crossing 21 million vehicles for CY 2015 looks possible. See the trend here:

When we compare this data to Indian market - Oct'15 Indian car sales for all OEM's included was 2,40,760 while GM alone was able to sell 2,62,993. Thus, GM Oct'15 sales > Indian Car Sales for Oct'15. Also small cars and compact sedans dominate the sales in the Indian market. Whereas, light trucks dominated the top 3 selling automobiles in US - No. 1 being Ford F-Series, 2nd spot held by Chevy Silverado and RAM 1500-3500 stood 3rd! A look at the top 16 best sellers -

The mentioned statistics is also very interesting - cars which are blockbusters in US, struggle for volumes in India:

Also to be noted is the Electric vehicles sales in US. Around 10,616 electric cars were sold in Oct'15 - More than what Ford (all brands included) could sell in India in Oct'15! Undoubtedly, Tesla emerged the No.1 electric car OEM and Model S led the charts with sales of more than 3.1k units! Statistics of the top selling Electric cars is as mentioned:

1. The U.S. auto industry reported the best October Sales in a Decade!

2. The complex nature of the U.S auto sales relatively to India

3. The sheer size of the American Car Market - No.1 Automobile market in World

4. The best performers in the American soil vis-a-vis our subcontinent

5. Recovery of the American automobile demand and a double digit growth in Oct'15!

Generally, October is a slow month for American OEMs. But favorable economic conditions and slew of incentives led the OEMs to escape the rather slow month and deliver a growth of 13.6% growth YoY basis. The figures looked like this -

|

| October 2015 Sales Data |

|

| Light Vehicles Sales Trend & OEM growth statistics |

|

| Top Sellers |

Also to be noted is the Electric vehicles sales in US. Around 10,616 electric cars were sold in Oct'15 - More than what Ford (all brands included) could sell in India in Oct'15! Undoubtedly, Tesla emerged the No.1 electric car OEM and Model S led the charts with sales of more than 3.1k units! Statistics of the top selling Electric cars is as mentioned:

We are amazed by the way American Auto Industry has evolved and is currently the highest volume churner for Automobile OEMs. The difference of US & Indian market is exemplary and that is why see so much variance in performance of the OEMs in both the markets.

References: