Thursday, September 29, 2011

Wednesday, September 28, 2011

Smart ways to achieve Financial Goals

Where will you be FINANCIALLY five years from today?

The financial secret of moving from where you are and where you want to be?

Would you like to know the financial secret behind moving from where you are and where you want to be? Try to answer this question. “Where will you be financially five years from now? 10 years from now…? 20 years from now…?”

You may get answers like “I will be financially stronger”, “I want to be financially better”. Are these answers specific? If you don’t know where you want to go exactly, there is no focus. When there is no focus; there will be lot of distraction. Distraction either leads to mediocrity or destruction.

How to refrain yourself heading towards mediocrity or destruction? You need to set Specific, Measurable, Achievable, Realistic and Time bound Financial Goals. That is S.M.A.R.T. Financial goals.

1) List down Financial Goals:

Write down all your financial goals like buying a house, kid’s education, Vacation, Retirement and so on. You may wonder why this mechanical act of writing financial goals is so important. You can be thinking something without actually realizing what that something is. It is intangible and so it is not clearly defined in your mind.

When you start putting that thought into words and you try expressing it, an amazing thing begins to happen. By creating it in words, that abstract thought now takes on body, shape, form, substance. It is no longer just a thought. It becomes something which motivates you, or creates a gut feeling inside.

Your dream becomes a goal the moment you write it down. Say one of your dreams is to buy a house. You dream about it a lot. But the moment you started writing it down, your mind will ask yourself “when, where, how many square feet, how many bedrooms?” This writing gives clarity to your goal and it forces your mind to find out the ways and means to achieve the goal.

2) Categorize and Prioritize:

You need to categorise your financial goals based on the timeframe. Generally the financial goals less than 3 years are short term financial goals. The goals to be achieved in the next 4 to 7 years are medium term goals and the financial goals to be achieved after 7 years are long term goals. This categorization will help you in building a roadmap to achieve your goals and also in selecting the right investment products.

Your daughter’s wedding would be more important to you than the international vacation. Buying a house is more important than buying a farm house. This prioritization will help you in creating a better financial plan. Suppose if you are in deficit, you know which financial goal need to be compromised and which are all the financial goals you want o achieve irrespective of the deficit.

3) Fixing a target date:

Fixing a target date for your financial goals may look like a dump idea. How do I know in advance the date of buying my house, the date of my daughter’s wedding? But if you are not fixing it, then you will not be financially prepared for that. If you are financially prepared and the goal event is not taking place at that time and getting postponed for some reasons, you will not have any financial worries. You will be financially ready from thereafter with on enough money to meet that goal.

Fixing a target date will psychologically influence your thought process to work on that goal. Also the moment you fix the target date your mind starts running a countdown. Only when you know that after how many years from now you want to achieve the goal, you will be able to make a financial plan.

4) Estimating the cost:

First you need to estimate the cost as of today. If you are planning to save for your daughter’s wedding which is expected to take place after 10 years, first you need to calculate the cost of the wedding in today’s prices. Then you need to adjust it for inflation of 10 years. Now you will have the future value of your target.

5) How much to save?

Once you have found out the future value of the goal, you can easily decide on how much you need to invest in order to reach the targeted future value. Initially you may only be able to contribute less. But year after year you can increase this contribution based on your increment/promotion/income growth.

So you need to take into account the expected growth rate on your salary or business/professional income in calculating how much to save towards each and every financial goal.

6) Budget the savings:

As you know by now exactly how much to save towards each and every goal, you need to accommodate these savings in your budget. If you do this year after year, then you can see all your financial goals becoming reality.

The difference between a goal and a dream is the written word. I am confident that you will come to find that financial goal setting works and that it will soon become a way of life for you.

Start setting your financial goals today.

The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.

Tuesday, September 27, 2011

Mahindra's Blue Ocean Strategy

In a recent interview Mr. Anand Mahindra made a remarkable statement - "We will create a system that is impregnable". The same could be highlighted from Mahindra's current position - it is the only company in the world to enjoy its presence in all mean of transportation, i.e. 'Air', 'Land' & 'Water'. According to Mr. Mahindra the most defensible strategy is to do multiple things and the combination of those multiple things becomes very hard for a competitor to emulate.

Air:

Recently Mahindra Aerospace & Government's National Aerospace Laboratories announced the successful maiden flight of their jointly developed C-NM5 aircraft, marking an important milestone in their collaborative aircraft development programme.

This is the first step of Mahindra Aerospace's dream "To do something potent in the regional aerospace - similar to what has been achieved in Rural Transport". This is backed by acquisition of Gipps Aero and Aerostaff in 2010. Both the Australia based companies were involved in manufacturing small aircrafts and thus suited Mahindra's vision to achieve 'economical air transportation around the world'.

The group is now also seen as the Indian Embraer! Anand Mahindra believes Indians would take to the skies if flying became affordable and Mahindra Aerospace will do everything to realize this dream. The dream of "Giving Wings!"

Water:

The company's vision is to lead the development of India's waterways and grow the marine recreation industry by offering customers an experience they will cherish. This further fuels Mahindra's ideology of having a presence in almost every segment of the transport ecosystem.

Land:

Air:

Recently Mahindra Aerospace & Government's National Aerospace Laboratories announced the successful maiden flight of their jointly developed C-NM5 aircraft, marking an important milestone in their collaborative aircraft development programme.

This is the first step of Mahindra Aerospace's dream "To do something potent in the regional aerospace - similar to what has been achieved in Rural Transport". This is backed by acquisition of Gipps Aero and Aerostaff in 2010. Both the Australia based companies were involved in manufacturing small aircrafts and thus suited Mahindra's vision to achieve 'economical air transportation around the world'.

The group is now also seen as the Indian Embraer! Anand Mahindra believes Indians would take to the skies if flying became affordable and Mahindra Aerospace will do everything to realize this dream. The dream of "Giving Wings!"

Water:

The company's vision is to lead the development of India's waterways and grow the marine recreation industry by offering customers an experience they will cherish. This further fuels Mahindra's ideology of having a presence in almost every segment of the transport ecosystem.

Land:

Mahindra & Mahindra (M&M) manufactures utility vehicles (UVs), tractors, commercial vehicles (CVs), three-wheelers and gensets. It is India's market leader in UVs and tractors. M&M, through its joint ventures

with Navistar, manufactures and markets medium and heavy CVs in India.

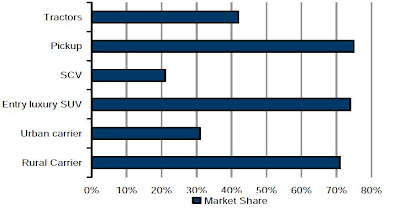

In land, Mahindra has dominant share in all its segments -

|

| Source: SIAM, Company Data, Credit Suisse estimates |

Mahindra earns a competitive advantage via a combination of a tractor and UV business in rural India. Both its UV and tractor businesses face very little competition and given that people earn their livelihood through most of their vehicles, its sales are less discretionary in nature. And Scorpio has proven to be a game-changer for the company and has help it transform its image from a people-mover to luxury SUV manufacturer. It has also become the group's flagship for expansion into new market.

One in two tractors bought today in India is badged M&M after the acquisition of Punjab Tractors. Two joint ventures in China, one with Jiangling and the other with Yueda Yancheng, has made it biggest tractor maker in the world in terms of volumes!

Also the acquisitions of Reva & Ssangyong has strengthened its dream.

All this was keenly observed by famous strategist and thinker Mr. C K Prahlad and named the whole milieu as "FORTRESS MAHINDRA". Fortress Mahindra means that if you go into a certain mobility business where you can share procurement, where you can share research and development synergies, where you can share logistics, where you can share brand, you can share channel and then create a mobility web where it becomes easier to enter a mobility business that somebody else can't and easier to defend when somebody tries to emulate.

And as the historic moment of the launch of its most-awaited XUV 500 arrives, we're sure that with this product M&M is sure of achieving its international dreams. We would like to end this post with wishing M&M all the best for XUV 500.

Reference: Business Today

Labels:

Fortress Mahindra

Sunday, September 25, 2011

Random Access - One

Business of Movies - II

Yes, that's the Abbreviation of the soon to be released Ra. One. The movie is said to be the most expensive Bollywood ever made and is slowly emerging as the costliest promoted movie of all times. The promotions started over seven months back; when its trailer was unveiled during the World cup semi-final match between India & Australia.

In my earlier post, i'd explained how pre-release marketing of movies has become an essential part in their success. This year a lot of good movies came who couldn't do up-to mark business because of poor promotional strategy. Shor in the City, Stanley Ka Dabba, Pyaar Ka Punchnama, I am Kalam did poor/pathetic business because people weren't even aware about the movies. While Bodyguard did all-time best Box-office collection backed by extensive promotions by Salman Khan and also associations with multiple brands (Tupperware, Audi AG, Dixcy, Maxo, Reliance & Philips). This has helped the producers to earn anywhere between 40 Lacs to 4 Crores!!! This not only allows financial support; but also continuous advertisements increase the visiblity.

Many big budget movies these days are making out their money even before release of their movie by selling out their music rights and television broadcasting rights. Ra One has earmarked a whopping 35-40 crores as their marketing budget out of which 10-15 crores would be used in online promotion of the movie. This has been emulated by Hollywood productions who start promoting their movies months or even years ahead of the release. We all know that the investments are huge and thus the production companies make sure they don't leave any stone unturned. The production company (Red Chillies Entertainment) has also planned to launch its own set of branded items - toys/merchandise, jewellery (partnership with Gitanjali), games (Sony & Indiagames to develop) and more.

Everything has been grand for the movie till now - be it the teaser, or the music release. The music has been composed by the Hollywood biggie Hans Zimmer who was behind some of the greatest Hollywood flicks (Ex: The Dark Knight). Even Akon was roped in to sing one of the songs - Chamak Challo composed by Vishal-Dadlani and has topped charts in no time. There is also a lot of hype generated on the looks of yet to be revealed villain of the movie - Arjun Rampal (named Ra. One).

But, will this strategy work for SRK? I'm sure this will ensure crowds in the hallsfor the first two days, but what after that? Excessive marketing can also boomerang and make it all predictable for the movie. However, Ra One promises a lot of firsts for Bollywood - hope even the Box office collections seems equally promising.

Yes, that's the Abbreviation of the soon to be released Ra. One. The movie is said to be the most expensive Bollywood ever made and is slowly emerging as the costliest promoted movie of all times. The promotions started over seven months back; when its trailer was unveiled during the World cup semi-final match between India & Australia.

In my earlier post, i'd explained how pre-release marketing of movies has become an essential part in their success. This year a lot of good movies came who couldn't do up-to mark business because of poor promotional strategy. Shor in the City, Stanley Ka Dabba, Pyaar Ka Punchnama, I am Kalam did poor/pathetic business because people weren't even aware about the movies. While Bodyguard did all-time best Box-office collection backed by extensive promotions by Salman Khan and also associations with multiple brands (Tupperware, Audi AG, Dixcy, Maxo, Reliance & Philips). This has helped the producers to earn anywhere between 40 Lacs to 4 Crores!!! This not only allows financial support; but also continuous advertisements increase the visiblity.

Many big budget movies these days are making out their money even before release of their movie by selling out their music rights and television broadcasting rights. Ra One has earmarked a whopping 35-40 crores as their marketing budget out of which 10-15 crores would be used in online promotion of the movie. This has been emulated by Hollywood productions who start promoting their movies months or even years ahead of the release. We all know that the investments are huge and thus the production companies make sure they don't leave any stone unturned. The production company (Red Chillies Entertainment) has also planned to launch its own set of branded items - toys/merchandise, jewellery (partnership with Gitanjali), games (Sony & Indiagames to develop) and more.

Everything has been grand for the movie till now - be it the teaser, or the music release. The music has been composed by the Hollywood biggie Hans Zimmer who was behind some of the greatest Hollywood flicks (Ex: The Dark Knight). Even Akon was roped in to sing one of the songs - Chamak Challo composed by Vishal-Dadlani and has topped charts in no time. There is also a lot of hype generated on the looks of yet to be revealed villain of the movie - Arjun Rampal (named Ra. One).

But, will this strategy work for SRK? I'm sure this will ensure crowds in the hallsfor the first two days, but what after that? Excessive marketing can also boomerang and make it all predictable for the movie. However, Ra One promises a lot of firsts for Bollywood - hope even the Box office collections seems equally promising.

5 Blunders To Avoid With Stock Market Fall And Viable Solutions

Lets Start Having A Look:

The present share market dip accompanied by a climate of pessimism in the share market calls for not just shrewdness in share dealing, but also for avoiding the 5 common blunders that I find most long term investors make during a share market fall. It is true that your precious savings needs to be protected and to grow, that makes me quote Ayn Rand, "Wealth is the product of man's capacity to think", so let us think and avoid those 5 common blunders.

Unveiling the 5 common blunders to avoid in stock market fall:

Being influenced with short term share market losses:

I have always advised young investors investing for long term capital gains to not panic if the value of their shares came down rapidly in just a year. It is not advisable to sell them to avoid further dips. A strong unchangable fact about the share market is that it is subject to ups and downs. The price of the shares would rise all of a sudden, and selling would only make it difficult to recoup your portfolio to meet your long term financial goals. The share market is like a voting machine in the short run and weighing machine in the long run, hence long term capital creation requires buying shares in an advantageous share market.

Short selling to make profits:

Short selling shares at a higher price, in the hopes to replace them by buying at a lower price proved risky for many investors. They all have soon realized that it was always better to have a cotton shirt on their back rather than aspire and fail in getting a silk shirt and have no shirt at all.

People believe that investment experts and large stock broking houses will be able to predict the market. If we watch and follow them we will be able to make quick bucks in short selling and F&O trading. Is that so? If there are investment experts who will be able to correctly predict the market they will not be writing or giving interviews about it in the media. They will be silently investing and making money without revealing their secret.

Most of the big names in the stock broking sector were opening more new branches in the upcountry side during the second half of 2007 (when the market was moving closer to 20,000 levels), expecting the market to go up further and hence their businesses will grow. But within six months, market had collapsed.

In the second half of the 2008 these companies decided to wind up their newer branches in the upcountry as they were expecting further downside. But again within next six months market started their recovery.

Never enter into shorting deals during a share market fall, but to hold on and invest more if you can make good returns in future.

Buying Penny Stocks of unknown companies in place of shares of reputed companies:

Market has fallen. You can invest now. Many investors fall prey for the idea of investing in penny stocks. You may think that you will get more number of shares when you buy penny stocks. Because you will get a very few stocks for the same amount if you choose to invest in large or midcap companies.

It is a universal advice that investing in thriving longstanding companies rather than, a less known company would guarantee you a good return in the long run. You should avoid investing a large sum in unknown penny stocks. It is always advisable to take calculated risks and not blind risks. By investing in a penny stock you are taking a blind risk which all successful investors avoid consciously.

Waiting for shares prices to fall further before buying:

When the market falls, that is a perfect time to start investing. Don’t wait for the markets to bottom out. It is difficult to identify the bottom and invest. By the time you recognize, that is the bottom level, the market could have bounced back.

Share market commentaries in the media always confuse us. When the market was at 20000 levels during Dec 2007, everyone in the media is predicting and analyzing the possibility of the market reaching 30,000 levels. But markets crashed subsequently. When they came down to 8600 level during Nov 2008 , everyone in the media is predicting analyzing the possibility of market going down further to 3,000 levels. But markets bounced back.

The prudent and smart investors understood this and started investing when the markets started falling. They have staggered their investments over a period of time. They followed simple strategies like systematic investment plan and systematic transfer plan.

I wanted high returns, but cannot see my capital fluctuating:

Some young and middle aged investors invest in high return portfolios with a lot of midcap exposure, and realize that their portfolios have fallen 15 to 20% with a share market fall in just 3 to 4 months. Their panic and decision to sell their shares for reinvesting the same in fixed return investments like Bank deposits or company deposits is wrong, and I would have advised them to just wait. Their present loss and reinvesting in fixed deposits would take them longer to recoup the capital and make sizable returns. The solution lies in sticking on to the share portfolio and be intelligent to buy more shares for long term wealth creation.

The final word:

My final word of advice for long term investors is to never allow emotions or short term fluctuations to alter their investment decision, and to always buy in a falling share market. I am sure a rational decision accompanied by safe dealings can make your long term financial goals a reality.

The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.

Wednesday, September 21, 2011

Do’s and Don’ts in the Stock Market

Let’s review do’s and don’ts of investing:

Most of us have our own perception of investment based on our experiences, but also tend to be confused with the opinions given by others. Knowing the do’s and don’ts of the stock market would help us turn really as a smart investor.

The do’s and don’ts in the stock market are:

Slow, steady, and boring wins the race:

It is best not to panic over information about stocks on the media. Being slow and steady with looking at the activities that your money is to be used for would ensure that you invest in ventures that are good, useful and profitable.

Reading good books on personal finance will help you in taking right financial and investment decision. In addition, finding good financial advisors would help you get advice regarding stocks and mutual funds, along with entrusting the custody and management of your funds to them.

All this may seem too boring and time consuming, but it is better to be cautious than bitten too hard.

Don’t give any weight to market forecasts. All opinion pro and con is already built into the price of equities today:

Market forecasts on the media has got good entertainment value but doesn’t have any investment value. It is just enough for long-term investors to invest in good stocks, and mutual funds that would appreciate in the long run.

It is best to understand that market forecasts only show you the expected direction in which the market is heading based on the available information. This forecast is only a forecast and need not become reality.

In addition, market fluctuations are the very nature of share markets and should mean nothing to long tem investors. Making accurate market forecasts is tough, as they are influenced by various factors like the outcome of political elections, the direction of the economy, interest rates and world events. It is also wise to know that these fluctuations are incorporated in the price of the share, stock or mutual fund.

Do make your own analysis of the stocks, shares and mutual funds:

It is unadvisable to place your full faith on analysis of others regarding stock, shares and mutual funds. No wise man would always tell you all about his market beating strategy. Making ones own analysis keeping your financial goals in view and framing a strategy would help.

This involves studying the performance of top performing stocks and mutual funds over 5 years and existing mutual funds over a period of 3 months to decide on which stock to maintain and which to dispose off. All this would ensure that you are investment smart.

Don’t think you can successfully engage in short-term market timing:

As a long- term investor you should never contemplate taking advantage of short-term market dealings and speculations. Playing with shares and mutual funds in the short-term market may give you a profit in a few transactions but will not give you profits forever. So you can’t have an investment strategy which gives profit inconsistently. We need a strategy which can bring profits consistently so as to be a successful investor in the long run.

It is true that playing in the share market is neither entertainment nor fun. It is also futile to borrow or work on short-term margins to make money.

Don’t assume that if anyone were genius enough to devise a market-beating strategy he would be stupid enough to share it with anyone:

Stock tips are good to learn, but not to act on for speculations. It could prove dangerous to act on speculation tips given by one and all, as they may not be correct. In addition, everyone has his or her own perception of investment, with other not having full knowledge or skills.

You need to take time to think over each tip and analyze if it contributes to your long-term objective of capital appreciation. Similarly it is not advisable to subject your money to risk with investing in investment fads that may or may not earn you huge profits.

The final advice:

You need to make a calculated decision considering the pros and cons whenever you make an investment. In addition abstain from trading often in the stock and mutual funds market. Always think in terms of long term investing.

(The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.)

Sunday, September 18, 2011

How to control unnecessary spending

Are you up for these 3 Financial Challenges?

Let’s begin learning:

The safest way to double your money is to fold it over once and put it in your pocket. ~ Kin Hubbard

Kin Hubbard is right in saying that if we do not spend money unnecessarily we would be able to save money and double it. However most of us like to spend and would find it difficult to not spend at all. We feel that it could stress us further.

Accepting the3 financial challenges could help you in controlling unnecessary spending. Once you control and avoid unnecessary spending you can save more and invest more. So you can achieve your financial goals easier and earlier.

Here are the challenges:

A Day Away from spending

The challenge of not spending for a day could be difficult, but could help save and render some important life lessons. It is true as most of us have regular daily expenses on coffee, tea, lunch, and snack at regular intervals and fuel to travel to and from work.

Effective planning with implementation of this challenge involves ensuring that your fuel tank is full on the earlier day. Then setting the coffee vending machine the night before could ensure you refreshing brewed coffee to enjoy before you leave for work. Similarly, carrying homemade lunch and healthy snacks like salads, nuts, seed and snack bars could help you eat healthy and save money.

It is not as difficult as it appears. Once you start practicing it, it becomes part of your habit like fasting. It opens new ideas to you on saving on daily routine expenses.

A Week Away from Credit Cards

We all tend to spend a lot on small and big purchases with using the credit card. Credit card tends to make us spend excessively on unwanted purchases.

Buying things on cash would only make us spend on things that we absolutely consider necessary. It is found that sometimes postponing the purchase and preferring to pay cash could make us realize that the need was just momentary.

During the week away from credit card, you will be able to understand some of your spending pattern. You will come to know on what items you make impulsive buying and on what items you make need based buying.

As you are using cash to buy and not plastic money, you may want to negotiate the price. This develops your negotiation skills.

It is also true that buying unnecessary things with credit cards causes financial stress and spoiling of important life relationships. So avoiding credit card for a week could make you a need based buyer and better negotiator.

A Month Away from Eating Out

The last challenge of not dining out for a month could be difficult for many today. This is difficult but you would realize on implementation that it saves you a lot of money that is usually spent eating out in restaurants and cafeterias.

Avoiding eating in restaurants would not only create huge savings, but also would help you avoid excesses in foods. In addition eating out only on special occasions as a family would help you enjoy the food. It would make the family realize the value of spending money lavishly.

When we have a kid around one year old, we won’t offer any outside food. We will pack the home made food or snacks for the kid. You can follow the same for the grownups.

Again this is not as difficult as you think. Think of having a homemade food as a family in a park or beach. This will bring a different experience and enjoyment to your family. This will give you new ideas on having more fun with lesser money.

A Final Note

All these challenges do not mean that you should not spend at all on dining out or on getting good things of life. It only means you should spend the right amount of money for the right reasons. This self-control would not only help you save more but also in preparing you psychologically for a consumerism

I am sure you would learn a lot with these spending challenges once you try them.

Image Source

Saturday, September 17, 2011

Automobile Basics

Automobile Basics

A Ready-reckoner on Automobile Basics. Can be used as an extensive guide to train automobile grads along with a glossary of technical terms. Tried to embed with visual representations wherever possible.

A Ready-reckoner on Automobile Basics. Can be used as an extensive guide to train automobile grads along with a glossary of technical terms. Tried to embed with visual representations wherever possible.

Friday, September 16, 2011

Instruction Manual for Investing

Let’s open the manual:

It is vital to chalk out a financial plan at the very beginning of our career. This plan would tell us how much we should save and invest. This plan also ensures that our long-term financial needs are met. It may prove difficult and sometimes costly in the long run if we chalk out a financial plan on our own. So it is better to engage a professional financial planner, who would be in the right position to advice us on the investments to meet our long-term objectives in life.

Every gadget you buy in the market comes with an instruction manual or user’s manual. But your salary, savings...retirement don’t come with an instruction manual. So we don’t know how to handle these and we end up mishandling. The result is poor investment choices and unhappy retirement. This article is an effort to draft an instruction manual for our investments.

Investment forms an integral part of our work life, with many wanting to save and invest to meet our long-term financial needs. We would all agree that just living from paycheque to paycheque would leave us in a bad financial state making us incapable of meeting our family’s financial commitments and our expenses after retirement.

Don’t Fly Blind; Have a Financial Plan

It is vital to chalk out a financial plan at the very beginning of our career. This plan would tell us how much we should save and invest. This plan also ensures that our long-term financial needs are met. It may prove difficult and sometimes costly in the long run if we chalk out a financial plan on our own. So it is better to engage a professional financial planner, who would be in the right position to advice us on the investments to meet our long-term objectives in life.

Generally investment advisors or financial planners ensure that we invest in the right type of investments that are relatively safe and tax efficient. They ensure that our investments do not divert away from the set financial goal. The advisors or planners who charge a fee, can be expected to act in the best interest of us; their clients. But we will not be in a position to trust those who live out of the commissions earned from selling insurance policies or mutual funds or stock broking.

However, it is best for you also to be cautious and not allowed to be fooled by flattery. Since it is your money you need to be cautious and vigilant.

Do control what you can:

The first thing that we can control is unnecessary expense on investment. It is in our interest to try to minimize or avoid investment expenses like entry load, exit load, fund management fees, commissions for buying and selling stocks, account maintenance fees, allocation charges, administration charges, surrender charges, and other overheads. Small drops make a mighty ocean. Similarly these small amounts of cost cutting will definitely pay us in the long run.

The second control is over the diversification of your investment. You also need to ensure that at all times your investments are done over a wider variety of assets. This will ensure that you do not suffer large losses in one type of investment. The losses in one would then be offset by the gains in the other and you will be financially safe at all times.

The third control is the maintenance of our asset allocation to reach our financial goal. We need to keep a check over the asset allocation or ratio of equity to debt and to other things in your portfolio with the help of a professional financial planner. This will help us ensure that we are not taking more risk than what we want or can possibly handle.

Do pay as little attention as possible to the financial media.

It is best not to be influenced too much by the media to buy and sell investments. Investing is not a competitive sport. Buying and selling stock frantically by being influenced by the media is counter productive to your financial objectives.

It is best to understand that our conscious investment is for long-term wealth appreciation. So we should not be distracted by the investment shows that run 24 hrs a day, investment column they publish 365 days a year. Media doesn’t understand your requirements. So it is difficult to get a customized solution for your personal finance.

Don’t fall into “Invest and Ignore”

We have invested your precious savings, so do not be careless and sleep over it. Though our investment advisor would make sure that our investment grows, it is better that we too are vigilant and keep track of market conditions. It is our precious savings that we have invested. So if we lose it, we would be losing not only money but also our peace of mind.

Don’t fall into “HNI Trap”

Being a high net worth person exposes us to being influenced to invest in dubious projects that may bring down your financial status. This is true because the financial industry are on the look out for people that have a lot of money and are of a high status. They try to influence them to invest in dubious projects appealing to their status and vanity.

Being a HNI doesn’t mean that you need a completely different set of investments. They try to pack something and will say “This is a HNI product”, just to massage your ego and get business. Many HNIs would be lot richer, if they could have bypassed their private banking department and just invested in an index and a very few diversified equity funds.

A final thought:

The instructions in the user’s manual need to be used to get the maximum benefit and long life of the gadget. Similarly, having read the set of instructions to make wise investment decisions, it is up to you to follow them strictly or leave it and go back to your routine life.

If you decide to follow these instructions, you will definitely see a lot of positive changes and financial prosperity in the long run. So today is going to be the first day for rest of your life.

(The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.)

Monday, September 12, 2011

My first Indiblogger Meet :)

When i received a mail stating "We can't wait to see you at the blogger meet this weekend!"; i thought 'so am I!'. The meet had already been postponed once and was happy to see the confirmation mail for September 10th. The association with Indiblogger was for more an year and had been a very interactive one. The meet just took our bond to the next level.

The venue was all decorated with Branding from Samsung and the only thing that hit the mind was "will I be able to get one of the tablets???". But, the coordinators made sure that every participant who comes early would get the demo piece. Hence I was blessed with the demo piece and was quite amazed with the capabilities it had to offer. Basically, I felt that I had my netbook without the keyboard. But, the size had a lot of questions to answer in terms of Display quality, Browsing Speed and Multitasking. And gotta to say it earned more than average points in each of the features mentioned above.

Now after the demo, we were asked to take video interviews of fellow bloggers from the tab and the best interview would be suitably awarded. So all of us with the intent of winning the prize followed up with the most interesting looking bloggers and pleaded for the interviews; must say was all more but fun. And yes, the camera quality was quite impressive.

The Intro was started well by the Indiblogger team and later was continued by the Samsung-wallahs(those who attended the event would easily recognize this). We were all enlightened about the brighter, clear and crisper 10.1" display (1280x800 LCD), the lighter weight of 565 grams, the much-evolved Android Honeycomb and the 1 GHz NVidia Tegra 2 Processor. The only thing that impressed me was its lovely display. If i'd the chance to own one, me would primarily use it only for watching movies and browsing (rather blogging).

It was then continued with the modified 47 seconds of fame (it was earlier coined as 60 seconds of fame) and the person utilizing more than the said amount was to be 'sent to jail'. This was the most interesting part for me as it allowed me to know all the fellow bloggers and their blog. The real-time twitter quiz was my first-of-kind experience but was let down as I wasn't able to connect to Twitter thru my tab.

It was then followed on by High Tea and allowed all the bloggers to interact and socialize. During this time I met a very interesting lady (journalist of Deccan Chronicle); and her thoughts kept me amazed for quite a while. Then each blogger was provided with a comment board where every one could intro themselves and their blog/tweet profile. The session ended with informative group discussions where my group landed discussing the pros/cons of Samsung Galaxy Tab 750 and then the future of Tabs.

And the most awaited time came - where the free Indiblogger tees were distributed. And thus I came back with the memories of the event all excited to pen down in my blog.

Some more pics of the event -

Saturday, September 10, 2011

Portfolio Management Scheme: A unique investment opportunity

What is Portfolio Management Scheme?

How to choose a best Portfolio Management Scheme?

There are so many Portfolio Management Schemes in the industry. So it is really very difficult to choose a good Portfolio Management Scheme provider. Here are some factors to be considered before choosing a Portfolio Management Scheme.

2) Minimum Investment Criteria:

Investors need to avoid Portfolio Management Schemes where the minimum investment is less than 25 lacs. Even there are Portfolio Management Scheme operators who keep minimum investment for their schemes as low as 5 lacs. But these kinds of Portfolio Management Scheme operators will have more number of PMS accounts. When the quantity (the number of PMS A\cs) goes up the quality (the performance) may relatively come down.

Therefore it is better to choose a Portfolio Management Scheme where the minimum investment is 25 lacs or more. So that our PMS A\c will be directly handled and managed by the top level portfolio manager and not managed by the juniors and analysts. If you are planning to invest less than 25 lacs, then the ideal investment product for you would be mutual funds.

3) Conflict of interest:

Portfolio Management Schemes have been run by some stock broking companies as well as investment management companies. There is a conflict of interest in Portfolio Management Schemes run by share broking companies. The main business of a share broking company is to earn commission income by facilitating the share market transactions.

Portfolio Management Scheme is an additional business for them. It is not their core business. Hence there may not be enough focus on the Portfolio Management Scheme business. Also they may indulge in doing undue and unnecessary churning of the clients’ portfolio to earn more commission income. This will cause additional expenses and short term capital gain tax to the client.

The core business of investment management companies is managing the investments of their clients to earn management fees. So, with the Portfolio Management Schemes run by investment management companies, there is no conflict of interest or vested interest. Therefore it is always advisable to choose a Portfolio Management Scheme offered by investment management companies.

4) Role of Professional Financial Planners:

A professional financial advisor or financial planner will study and analyse the Portfolio Management Schemes run by various stock broking companies as well as investment management companies. If we approach them, they will guide us in choosing the right Portfolio Management Scheme depending upon our requirements and other factors.

Also a professional financial advisor will continuously monitor the performance of various Portfolio Management Schemes and advice the client on a regular basis on the performance of the Portfolio Management Scheme where the client has invested vis a vis the other PMS schemes in the industry. After a certain period, if necessary he may advice you to move from one Portfolio Management Scheme operator to the other.

ESOPs and Portfolio Management Scheme:

ESOPs are provided by the companies to its employees based on their service. Most of the employees are of the opinion of keeping the ESOPs as it is forever because it is their company shares. But logically it is too riskier to invest in a company to whom you work for. Because, your employment income as well as investment income will depend on the performance of a single company.

So it is not advisable to keep your investments in a company where you actually work. So it is at all times advisable to transfer your ESOPs to a Portfolio Management Scheme. They will revamp it to construct a well diversified portfolio.

• Who have a share portfolio and find it difficult to manage.

• Who have enough exposure in Mutual funds and looking for a different and good investment option

• Who have sizable ESOPs.

Portfolio management scheme popularly known as PMS are specialized investment vehicle for lump sum investments. The portfolio manager invests the money in shares and other securities and manages the portfolio on behalf of the client.

One can invest fresh money in Portfolio Management Scheme and the portfolio manager will construct a portfolio by deploying that money. Also one can transfer his existing share portfolio to the Portfolio Management Scheme provider. In that case, the portfolio manager will revamp the portfolio in sync with his investment philosophy and strategy.

Once the Portfolio Management Scheme account is opened, the client will be given with a web access to his portfolio. The client can look at where the portfolio manager is investing client’s money. Also one will be able to generate reports like Investment Summary, Portfolio Transaction List, Performance Analysis, Portfolio Statement and Quarterly capital gain report.

As a result, Portfolio Management Scheme relieves investors from all the administrative hassles of investments.

Portfolio Management Scheme Vs Direct Stock Market investment:

One can directly invest in stock market. Then what is the advantage of investing in the stock market through a Portfolio Management Scheme. Investing in share market demands knowledge, right mindset, time, and continuous monitoring. It is difficult for an individual investor to meet all these demands. But a Portfolio Management Scheme meets these demands easily. The Portfolio Management Scheme will be managed by an experienced professional. It saves the time and effort of the individual investors. Hence it is advisable to outsource the stock market investment to a sound Portfolio Management Scheme operator instead of managing it on our own.

Portfolio Management Scheme VS Mutual Funds:

Mutual fund is also a good investment vehicle. It should also form part of your total equity investment. But mutual funds are mass products. So they will be conservative by nature. As per SEBI regulation, mutual funds have some investment restrictions. There is a maximum limit on the percentage of amount invested in an individual stock. Also there is some maximum cap on the exposure in a particular sector.

Once the fund manager reaches the maximum limit prescribed by SEBI, he is forced to invest in some other stock or some other sector. That is why we see a large number of stocks in a mutual fund portfolio. Where as a Portfolio Management Scheme will invest in 15 to 20 stocks. This concentration makes it more attractive and aggressive. Managing a 25 lakhs Portfolio Management Scheme portfolio will be more flexible when compared to managing a 2000 crores mutual fund portfolio.

Portfolio Management Schemes relatively have more flexibility to move in and out of cash as and when required depending on the stock market outlook.

Basically the conservative portion of your equity investment can go into mutual funds. The aggressive portion can go into Portfolio Management Scheme.

How to choose a best Portfolio Management Scheme?

There are so many Portfolio Management Schemes in the industry. So it is really very difficult to choose a good Portfolio Management Scheme provider. Here are some factors to be considered before choosing a Portfolio Management Scheme.1) Yardstick for Performance:

One should not just go by the past performance alone. Making an analysis on various Portfolio Management Schemes in the industry with their past performance along with the risk adjusted return and the consistency of performance will be useful in selecting the best Portfolio Management Scheme.

2) Minimum Investment Criteria:

Investors need to avoid Portfolio Management Schemes where the minimum investment is less than 25 lacs. Even there are Portfolio Management Scheme operators who keep minimum investment for their schemes as low as 5 lacs. But these kinds of Portfolio Management Scheme operators will have more number of PMS accounts. When the quantity (the number of PMS A\cs) goes up the quality (the performance) may relatively come down. Therefore it is better to choose a Portfolio Management Scheme where the minimum investment is 25 lacs or more. So that our PMS A\c will be directly handled and managed by the top level portfolio manager and not managed by the juniors and analysts. If you are planning to invest less than 25 lacs, then the ideal investment product for you would be mutual funds.

3) Conflict of interest:

Portfolio Management Schemes have been run by some stock broking companies as well as investment management companies. There is a conflict of interest in Portfolio Management Schemes run by share broking companies. The main business of a share broking company is to earn commission income by facilitating the share market transactions. Portfolio Management Scheme is an additional business for them. It is not their core business. Hence there may not be enough focus on the Portfolio Management Scheme business. Also they may indulge in doing undue and unnecessary churning of the clients’ portfolio to earn more commission income. This will cause additional expenses and short term capital gain tax to the client.

The core business of investment management companies is managing the investments of their clients to earn management fees. So, with the Portfolio Management Schemes run by investment management companies, there is no conflict of interest or vested interest. Therefore it is always advisable to choose a Portfolio Management Scheme offered by investment management companies.

4) Role of Professional Financial Planners:

A professional financial advisor or financial planner will study and analyse the Portfolio Management Schemes run by various stock broking companies as well as investment management companies. If we approach them, they will guide us in choosing the right Portfolio Management Scheme depending upon our requirements and other factors.Also a professional financial advisor will continuously monitor the performance of various Portfolio Management Schemes and advice the client on a regular basis on the performance of the Portfolio Management Scheme where the client has invested vis a vis the other PMS schemes in the industry. After a certain period, if necessary he may advice you to move from one Portfolio Management Scheme operator to the other.

ESOPs and Portfolio Management Scheme:

ESOPs are provided by the companies to its employees based on their service. Most of the employees are of the opinion of keeping the ESOPs as it is forever because it is their company shares. But logically it is too riskier to invest in a company to whom you work for. Because, your employment income as well as investment income will depend on the performance of a single company. So it is not advisable to keep your investments in a company where you actually work. So it is at all times advisable to transfer your ESOPs to a Portfolio Management Scheme. They will revamp it to construct a well diversified portfolio.

Portfolio Management Scheme is an aggressive investment product and really suitable for those investors

• Who have a share portfolio and find it difficult to manage.

• Who have enough exposure in Mutual funds and looking for a different and good investment option

• Who have sizable ESOPs.

(The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.)

Image Source

Image Source

Friday, September 9, 2011

The Escape ain't over my friend

|

| Mahindra Great Escape - Mysore |

|

| Silent Shores Resort, Mysore |

|

| Flag off |

The convoy had to cover a trail of 95 kms and a stretch full of mud, sand, slush, rock, sand, filth and damp soil. Although the track wasn't all difficult to conquer, it did have some very exciting points which tested the driving capability of the vehicle to the fullest. It had a line of 28 vehicles which acted as brothers in arms and amazed the audience it had during the whole path. Most of the villagers thought that some Sandalwood (Kannada) movie was being shot and were searching for the Actor 'Darshan'.

|

| The excitement among the crowd kept us entertained too |

The most amazing part of the drive was the unexplored and striking meet with nature. The lakes, fields, narrow ways, slush and the drizzle helped us "re-claim" our part of life.

Now coming to the heart of the show - the participants itself!!!

First initiated in 1996, the Mahindra Great Escapes have evolved into spectacular weekend events. The routes are meticulously chosen to ensure excitement without compromising on safety. All through the route, there are rescue vehicles to help those in need. In addition, there are experts along the route who are ready to guide the drivers through difficult terrain that may require skilful driving.

|

| The Best Pic |

Labels:

Mahindra Great Escape - Mysore